Credit Report Dispute Letter Template. Researchers suggest that when individuals pay using credit cards, they don’t expertise the abstract ache of fee. Typically, rewards are either within the type of cashback or factors. Again, this is why it’s so necessary to make use of certified mail and retain all data and receipts. Make a copy of your letter in your personal reference, notice necessary dates , and keep all associated files together and organized.

The ultimate part of the letter is the place you go for the close. One strategy is to make your credit report inaccessible to lenders and creditors with a credit freeze. If you have a membership, log in and obtain Illinois Sample Letter for Corrections to Credit Report via the US Legal Forms assortment.

The fee is often a percentage of the transaction amount, plus a fixed charge . So if the companies furnishing the data, confirm the errors in your report as being correct, this gets left in your credit score report and there is little or no you can do about it. (Provide particulars about every inquiry including the date and the name of the company. Mention why you consider the inquiry is incorrect). Bank of America chose Fresno as a outcome of 45% of its residents used the financial institution, and by sending a card to 60,000 Fresno residents directly, the financial institution was in a position to persuade merchants to just accept the cardboard. As you have failed to do so, I kindly request that you simply take away the aforementioned objects from my credit score report.

When you have troublesome conditions to resolve, it could be worthwhile to hire a good credit score restore company. They will know precisely what your scenario needs to find a way to resolve shortly.

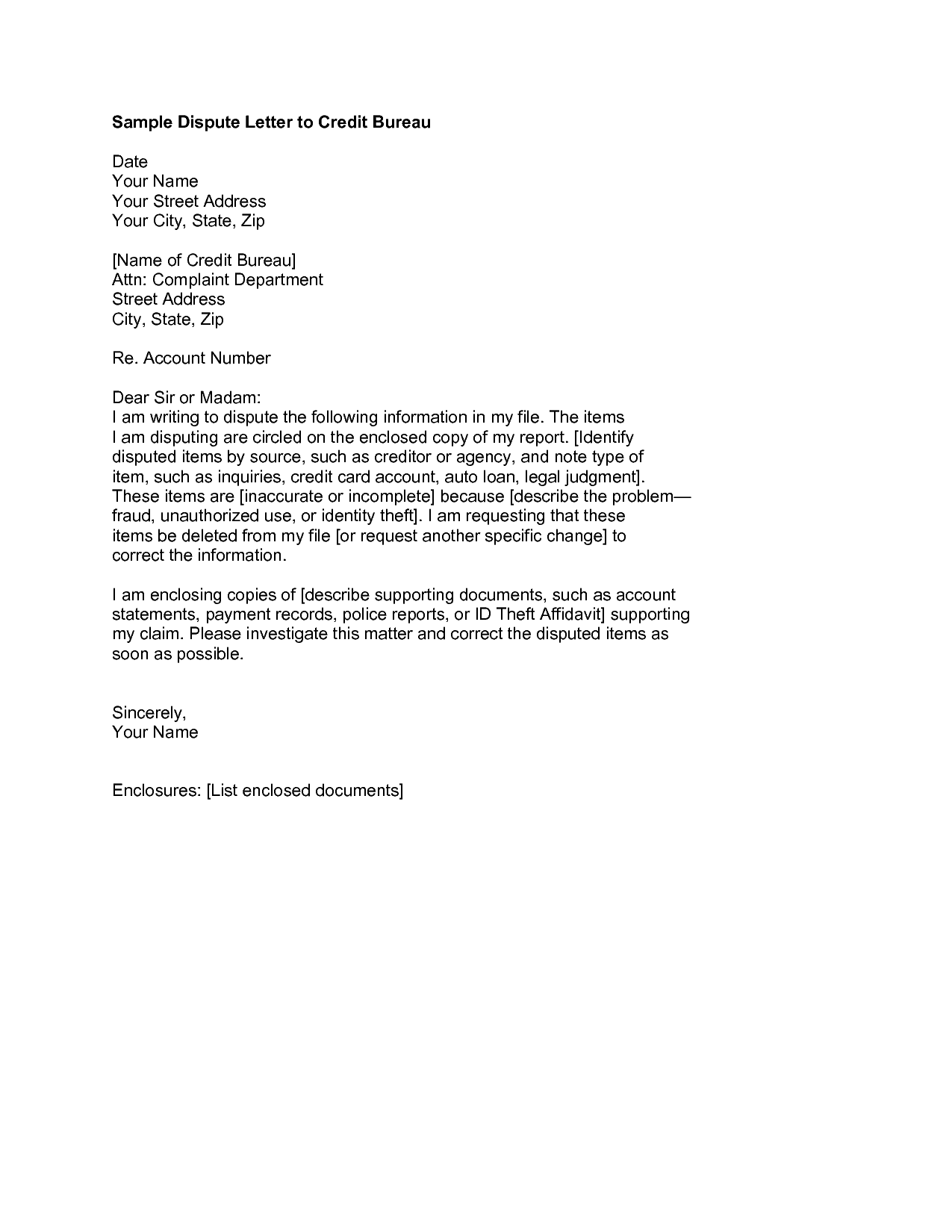

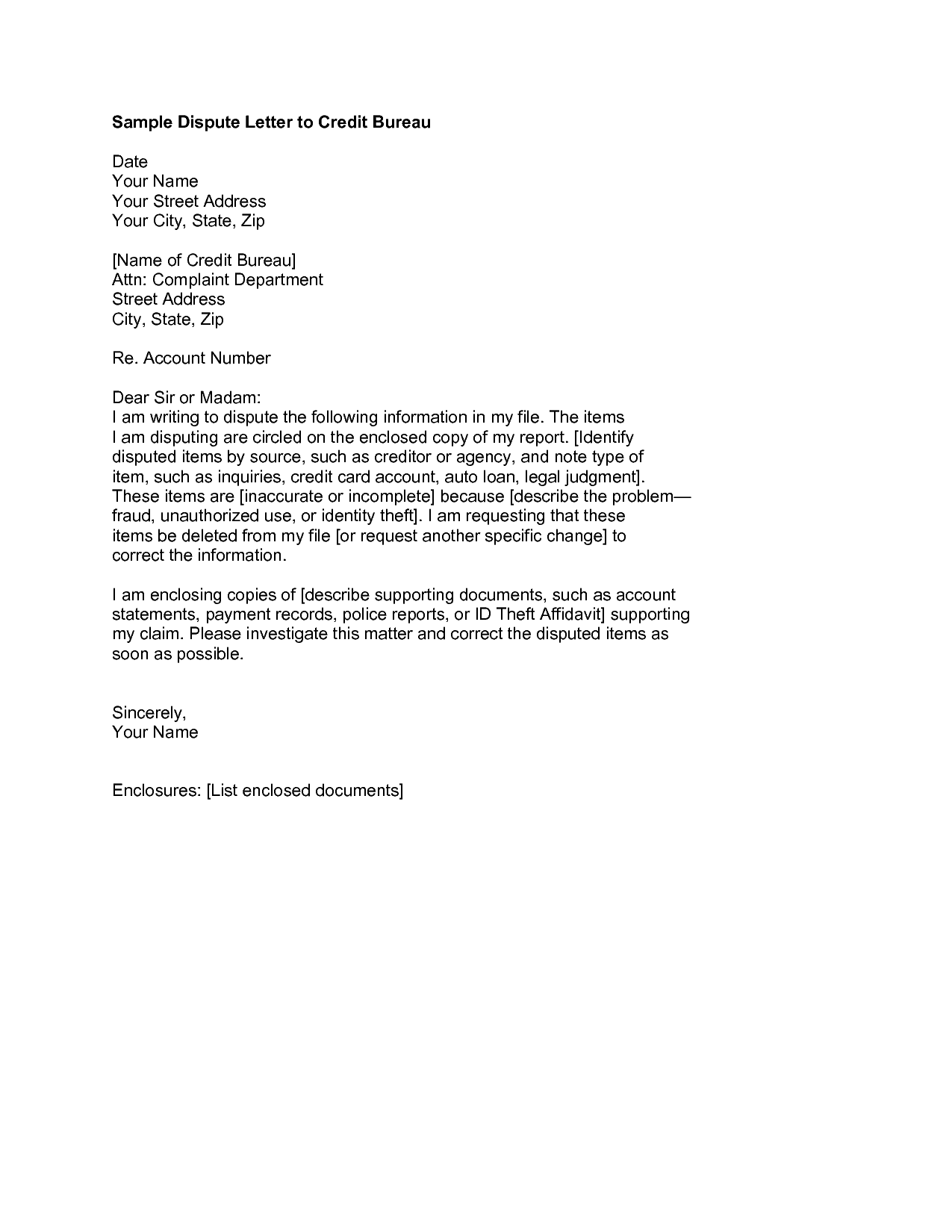

You can send one letter for all the errors discovered within the credit score report. You will have to submit a letter to every bureau for the errors within the report.

How To Accurately Dispute Data In Your Credit Score Report

California loans arranged pursuant to Dep’t of Business Oversight Finance Lenders License #60DBO-78868. If you’ve debt in collections, think about finding aNational Foundation for Credit Counseling-certified counselorto allow you to create a debt management plan instead.

Delegation Letter SampleA Delegation Letter is a formal letter written with an intention to delegate the roles and duties to another person so that the work doesn’t get disturbed in your absence. Delegation Letter contains full information of all the duties and jobs that are delegated to a particular person in a specified scenario.

What To Incorporate In A Credit Score Inquiry Removing Letter

Often, there are “teaser” charges or promotional APR in impact for initial durations of time , whereas regular charges can be as excessive as forty %. Other states, for instance Delaware, have very weak usury legal guidelines.

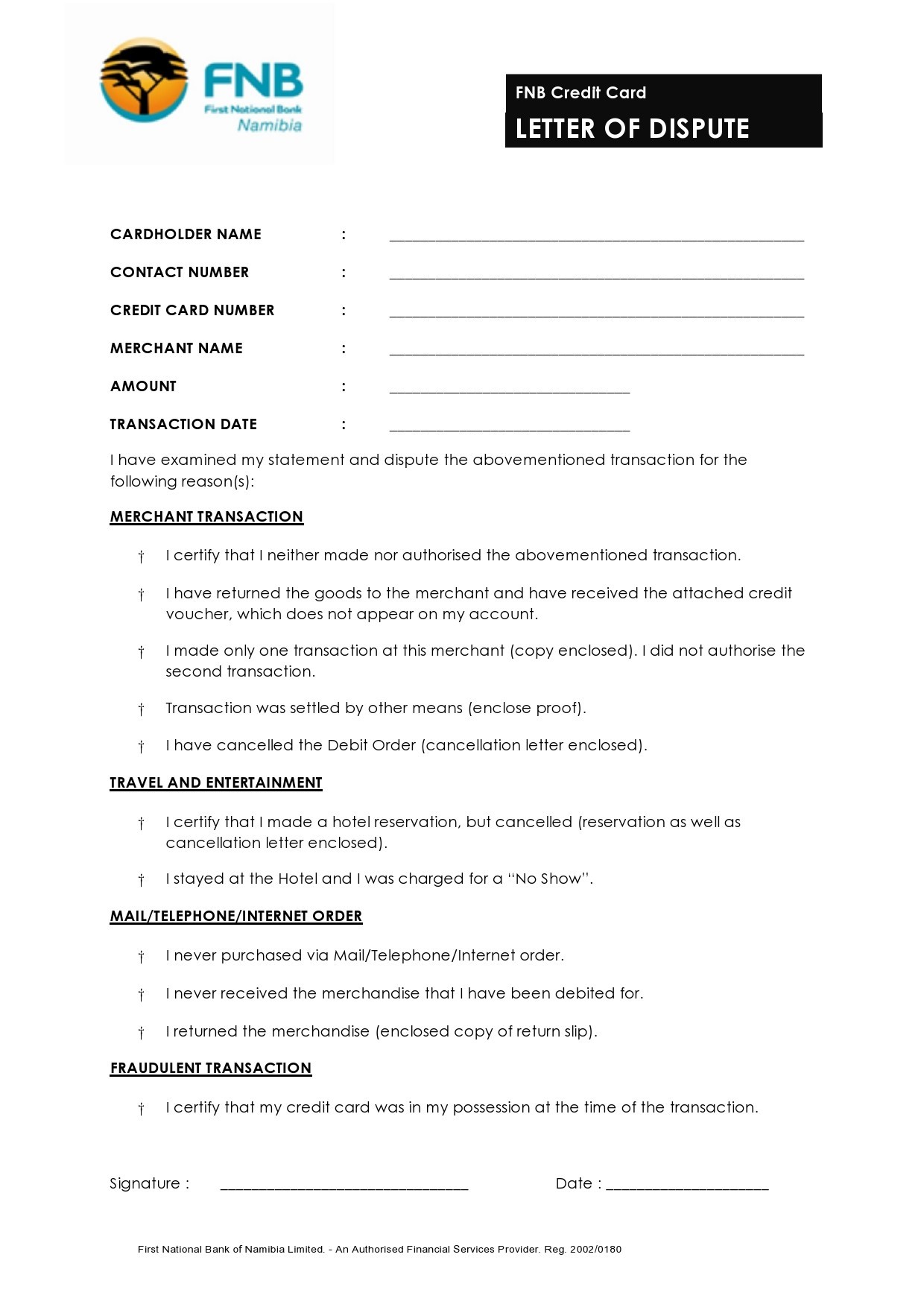

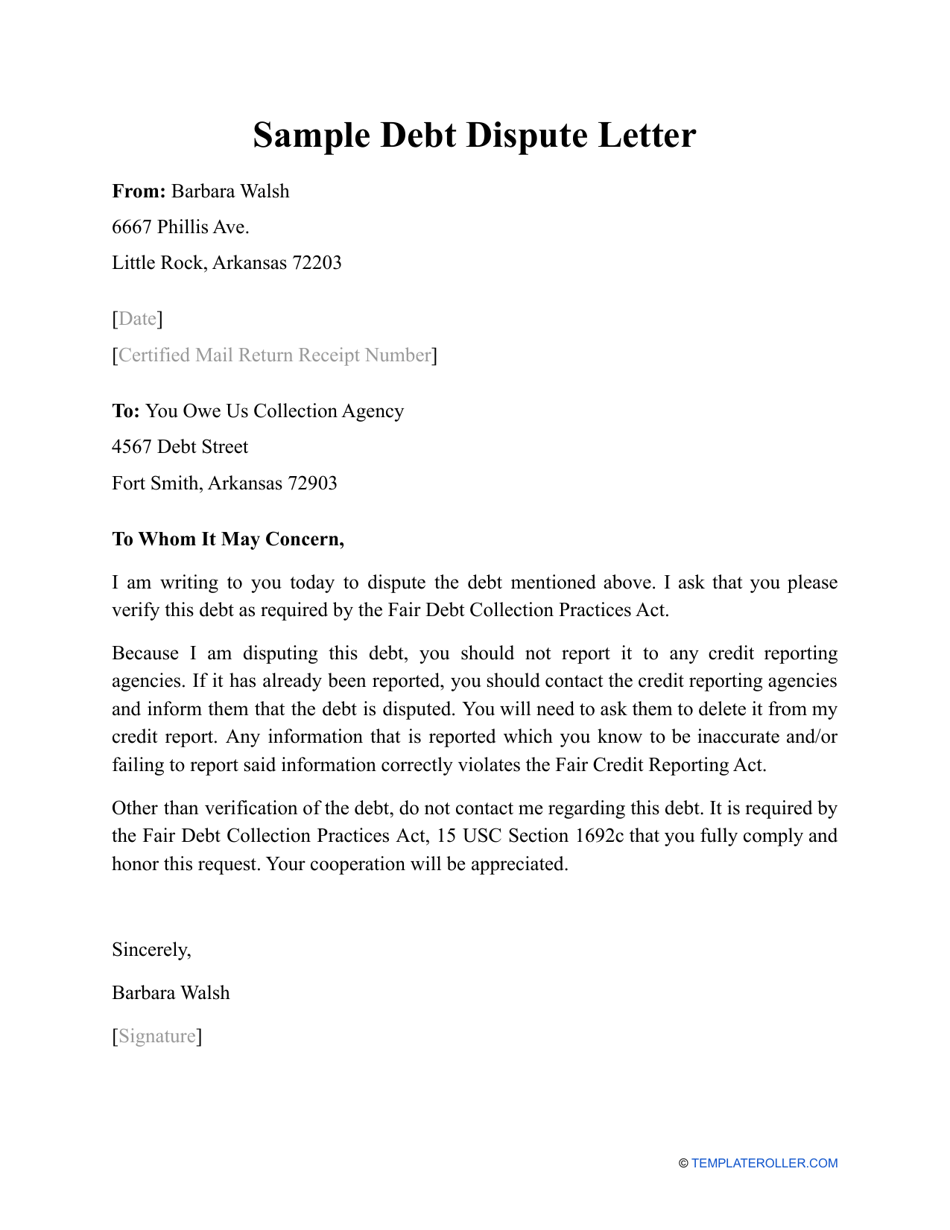

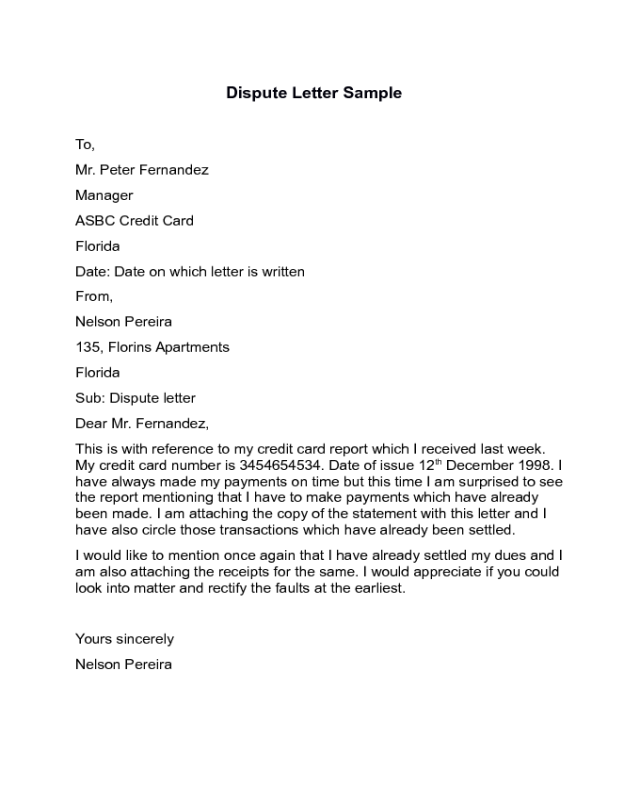

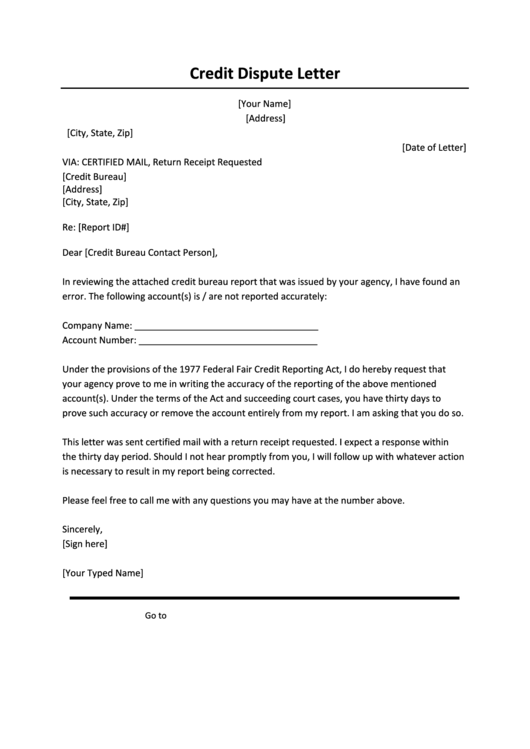

If you fail to offer a response, all disputed data should be deleted. When writing your dispute letter, you will need to embody all relevant data, in addition to several key parts, so as to create an effective, impactful letter.

The design of the bank card itself has turn into a major promoting level in recent times. Early bank cards had been made from celluloid plastic, then steel and fiber, then paper, and at the second are mostly polyvinyl chloride plastic.

With careful consideration to detail, you need to find yourself with a letter that is direct, convincing, and efficient. Each of the next templates is independent of one another, with the exception of Template #4, which is a basic follow-up to any of the primary three letters.

What Am I Ready To Dispute On My Credit Report?

This indirectly impacts the passing of your loans and proscribing your banking features. It pertains to the Fair Credit Reporting Act , which instructions the buyer rights to info on credit score reviews. The section addresses the rights to request copies of credit score reports and relative information.

S.s.# (social safety #)HIPAA Compliance OfficeDear Sir/Madam;This letter is in reference to (account #) for companies provided to on . Letter To Health Care Providers This letter should ONLY be used AFTER the preliminary dispute letter has provided you with a documented current relationship between the Health Care Provider and the reporting CA. Ranked #1 in tackling inaccurate credit score entries, Credit Saint is appreciated by almost every other consumer company.

However, It is a time-consuming process; it works however with no guarantee. The Credit bureau verifies a sure entry using proof corresponding to signed bills, statements, or contracts. Any form of proof is suitable, and in case you have a replica of the proof, you can connect it and ship it to them.

If you don’t hear from the company inside two weeks, follow-up with a phone name. Student loan servicing agencies are notoriously gradual, so you may have to make a pest of yourself. Enclosed are copies of evidence of funds on the account for the previous six months, in addition to the most recent statement notification showing the account is active and in compensation standing.

VantageScore, another well-liked credit score scoring Here’s probably the most in depth library of dispute letters in case you have late payments in your credit report. Section 609 is designed to guard the pursuits of shoppers and get them the right to info. No doubt, the credit score repair corporations work their finest to improve the credit scores, however it is very important know that your data can be disputed if wrong.

To be more particular, based mostly on FCRA , you have been required to forward the entire relevant data I supplied by you to the creditor for his or her investigation of my dispute. Disputes prepared in as quick as 72 hours, The Credit Fix guy is our ready-to-go credit score restore firm.

US Legal Forms provides 1000s of approved varieties which are reviewed by specialists. It is possible to acquire or print the North Dakota Sample Letter for Erroneous Information on Credit Report from the assistance.

You ought to check your credit score report a minimal of once per yr to confirm the knowledge in it. If you find errors, you could have the proper to dispute them with the credit score bureau.

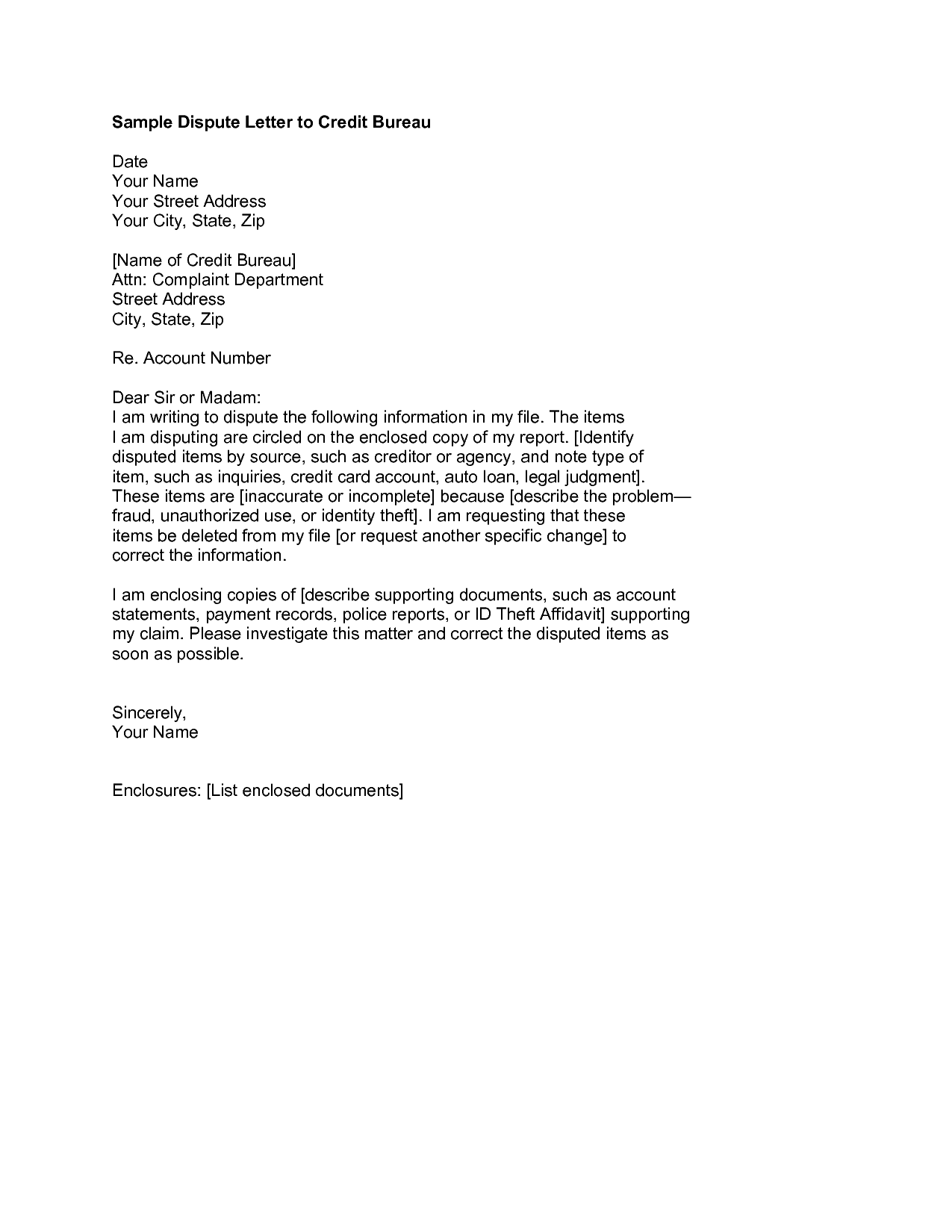

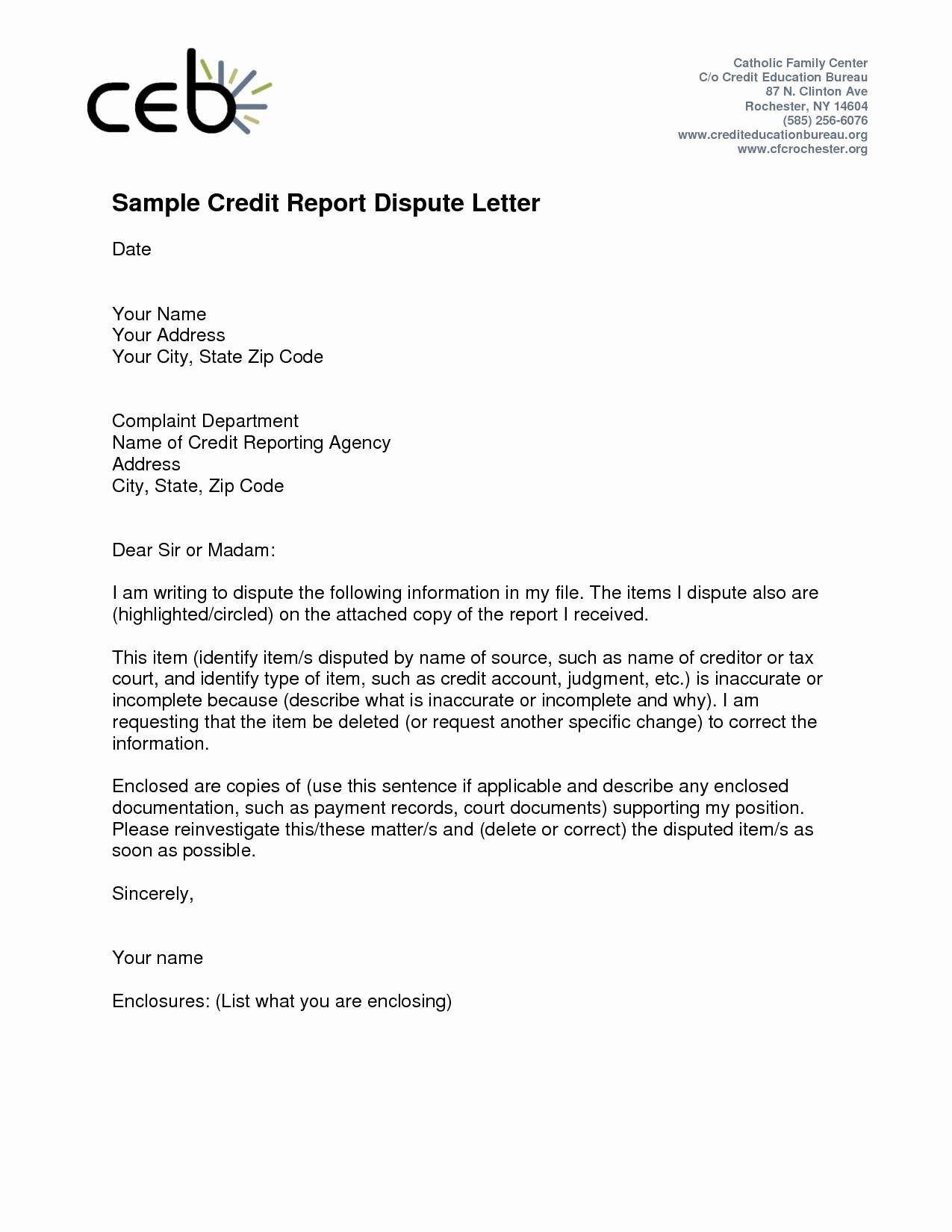

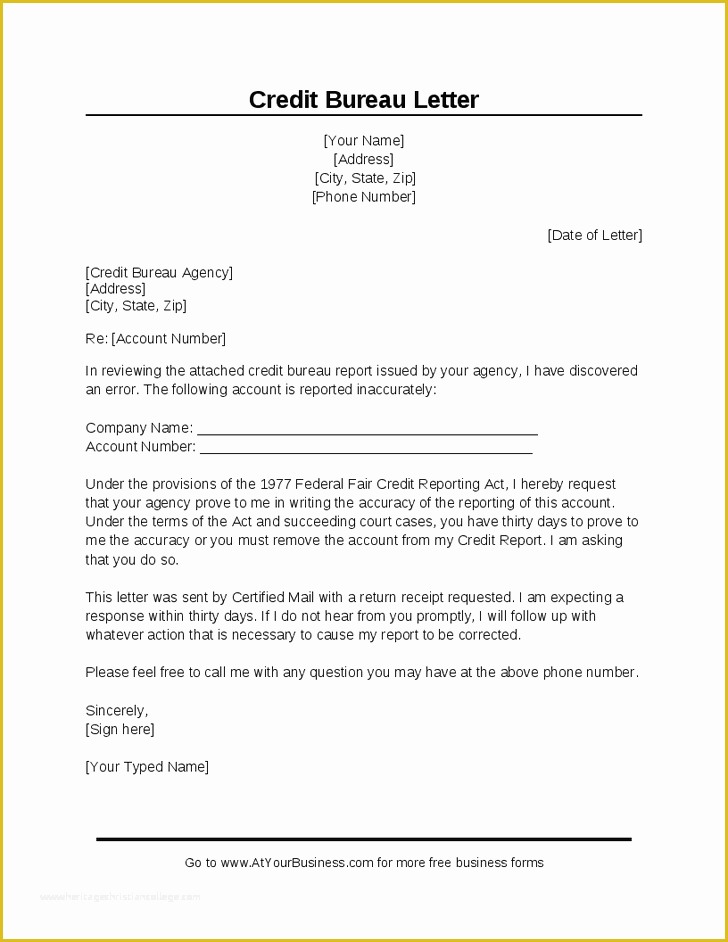

We’ve included a pattern credit score report dispute letter that you can ship to credit bureaus. Use it to request an update to, or removal of, inaccurate info on your credit score report.

Visit our legal professional directory to find a lawyer near you who may help. You can provide them one thing in return, like paying off a loan that you’re behind on. Amy is an ACA and the CEO and founder of OnPoint Learning, a financial coaching company delivering training to financial professionals.

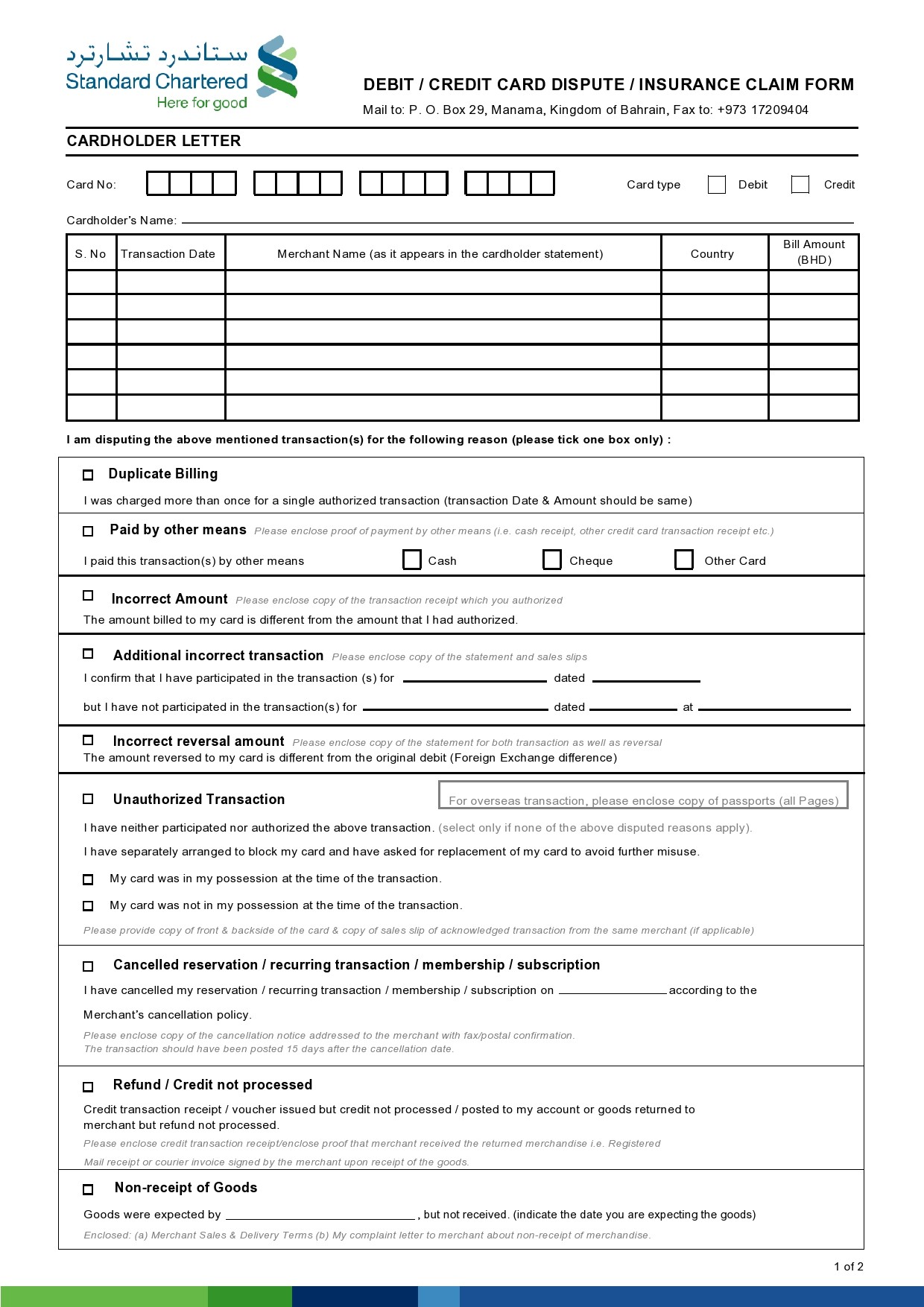

When you believe you studied one or more credit score bureaus are reporting one thing incorrectly in your credit score file, you presumably can ship them a credit score dispute letter . That requires them to investigate and resolve your declare within 30 days. Now, you’ll have the ability to fully bypass the credit score bureau and dispute directly with the enterprise that reported the error to the credit bureau, e.g., the credit card issuer, financial institution, or debt collector.

After figuring out your report, you’ll need to offer info on the error, as nicely as an evidence as to why you’re disputing the item. And finally, your credit dispute letter should embrace a request for the credit score bureau to remove the merchandise from your credit report.

A cost coin often had the charge account number along with the merchant’s name and logo. In 2018, there were 1.12 billion bank cards in circulation in the united states, and 72% of adults had a minimum of one card.

Most mortgage contracts outline clearly how the proceeds might be used. There isn’t any distinction made in legislation as to the type of mortgage made for a brand new house, a car, the means to repay new or old debt, or how binding the phrases are.

Even should you think about yourself to be somewhat savvy when it comes to getting things down on paper, you might discover writing your credit dispute lettera bit out of your consolation zone. The Government of Canada maintains a database of the charges, features, interest rates and reward packages of almost 200 bank cards obtainable in Canada.

I am exercising my proper beneath the Fair Credit Reporting Act, Section 609, to request … It was not properly transmitted in a timely manner to my insurance firm. Once you’re here and you are feeling that the company didn’t take away faulty item, then it’s time to begin writing your Method of Verification letter.

Most generally used quantum monetary models are quantum continuous mannequin, quantum binomial mannequin, multi-step quantum binomial model etc. With extra in-depth analysis into behavioral finance, it’s possible to bridge what really happens in monetary markets with evaluation based mostly on monetary theory. Behavioral finance has grown over the last few a long time to become an integral aspect of finance.

You can do this order to guard your self from unscrupulous collectors and overworked credit score bureaus. Download oursample letter and directions to submit a dispute with a credit reporting firm.

US Legal Forms is unquestionably the most significant library of licensed varieties the place you’ll find quite lots of papers templates. Take advantage of the service to amass skillfully-manufactured papers that persist with state necessities. Should you be presently authorized, log in to the accounts and then click the Acquire change to have the Indiana Sample Letter for Corrections to Credit Report.

Speak with our credit score specialists at present and start your path in path of a greater credit score rating. Marie has spent her career with more than 5 years writing for distinctive media retailers like Yahoo finance, GoBankingRates, and CNBC. She additionally teaches them how to plan strategically to get out of mortgage debts easily.

Also, request that it be sent through certified mail with a return receipt so you’ll know precisely when the letter arrives at its meant destination. If contacting a collection agency, include the original account number. However, it’s as much as you to get in contact with Experian, Equifax, and TransUnion to ask these bureaus to take away objects they can not validate.

These apps can warn you when your rating decreases or increases. They’ll additionally try to sell you bank cards via e mail however this could be a small worth to pay for such an easy way to monitor your credit.

They are the ones who supplied the adverse data, so it only is sensible to take up the problem with them first. That is as a result of the perpetrators usually use forged or stolen documents that “proved” they had been you once they opened the account. This can make it very troublesome for you to prove that you have been not, in fact, the one who opened the account.

And disputing it with one credit reporting agency, doesn’t mean will in all probability be corrected on all three. The Fair Credit Reporting Act entitles you to a free copy of your reviews a minimal of once each 12 months.

[ssba-buttons]