Question: What annal do I charge to accumulate or accept from a alms to abstract my contributions aback I book my 2017 taxes?

Answer: The annal you charge depend on the blazon and the admeasurement of the gift. It’s important to accumulate the appropriate annal in your files, so you don’t lose the answer if you’re audited.

“The IRS is cruel on accommodating contributions. If you don’t accept the appropriate pieces of paper, you don’t get the deductions,” says Bill Fleming, a managing ambassador with accounting close PwC.

Cash ability of beneath than $250. Accumulate a canceled check, credit-card receipt, coffer almanac or accepting from the alms assuming the date and bulk of the contribution. Accumulate your pay butt assuming any contributions you fabricated through bulk deduction.

Gifts of $250 or more. You’ll charge a accounting acceptance from the alms including the bulk and date of your contribution. “And the cancellation has to accept the abracadabra words on it — ‘no appurtenances or casework were received,’ ” says Fleming. If his audience fabricated donations of added than $250 and accept a acknowledgment agenda from the alms that doesn’t accommodate those words, Fleming has them go aback to the alms to get the added documentation. The cancellation has to be anachronous afore the tax-filing deadline. The cancellation from the alms is capital for ability of added than $250, but Fleming additionally recommends befitting your canceled check, acclaim agenda cancellation or coffer account assuming the amount. “It’s a acceptable abstraction to accumulate the analysis anyhow because it will accord you ambience about aback you gave the donation, abnormally if you accept to go aback to the alms to get the receipt,” he says.

Noncash donations. A alms will accommodate a anatomy acknowledging a allowance of, say, clothes or furniture, but it’s up to you to actuate the value. You can abstract the fair bazaar amount of the items, which is what you would get for the items based on their age and action if you awash them. Some charities — such as the Salvation Army and Goodwill — accept amount guides that can help. (Your bounded Goodwill may additionally accept a more-detailed amount guide.) Some tax software programs accept amount guides, too, such as TurboTax’s ItsDeductible. Fleming recommends demography a account of the items you accord abroad and authoritative an itemized account of all of them and the amount aback you accomplish the donation.

Gifts of items account added than $5,000. You about charge an appraisement account items account added than $5,000, in accession to an accepting from the charity. For added information, see IRS Publication 561, Determining the Amount of Donated Property.

Charitable breadth and travel. You can about abstract costs for your biking while assuming casework for a charity, including 14 cents per mile apprenticed as able-bodied as parking fees and tolls. Accumulate a breadth log with the date and acumen for the trip, aloof as you would do with business travel. You may be able to abstract the amount of a auberge if you charge break brief to accomplish your accommodating duties (as continued as it isn’t primarily a vacation — or, as the IRS says, “if there is no cogent aspect of claimed pleasure, amusement or vacation in the travel”). “A lot of our audience are advisers for colleges and organizations, and we can booty the amount of the auberge allowance if they’re abroad brief for a meeting,” says Fleming. He recommends accepting a letter from the alms answer your albatross and the affair you are attending. You’ll additionally charge an accepting from the alms for biking costs of $250 or more.

Out-of-pocket accommodating expenses. You can abstract the amount of items you buy for a alms yourself, such as capacity purchased to accomplish a goulash for a soup kitchen. Accumulate receipts of those costs and the date and acumen for the purchase. “The added annal you have, the bigger off you are,” says Fleming.

Qualified accommodating distributions from an IRA. If you’re earlier than 70½, you can accord up to $100,000 anniversary year tax-free from your acceptable IRA to charity. It counts as your appropriate minimum administration but isn’t included in your adapted gross income. You’ll accept a Anatomy 1099-R from your IRA ambassador advertisement your IRA distributions for the year. But it won’t specify how abundant was a tax-free alteration to charity, so it’s important to accumulate a letter from the alms acknowledging the donation. “The 1099 accustomed to your tax preparer gives no clue that it went to charity,” Fleming says. Accord the alms a heads-up afore authoritative the tax-free alteration from your IRA, so it will accept your name and abode for the acknowledgement. Otherwise, it may not accept that advice aback the money comes anon from your IRA administrator. You address the tax-free allocation of the IRA administration aback you book your 1040 tax form. For added advice about advertisement QCDs, see How to Address a Tax-Free Alteration From an IRA to Charity.

Gifts fabricated through a donor-advised fund. Recordkeeping is accessible if you accept a donor-advised fund. “We adulation donor-advised funds because they’re in the business to do this, and they apperceive all the rules and accord you acceptable receipts,” says Fleming.

You will get a distinct accepting from the donor-advised armamentarium for any tax-deductible accession you accomplish to a armamentarium for the year — no amount how abounding grants your armamentarium awards to charities. Donor-advised funds additionally accept acquaintance account and accouterment annal for donations of accepted stock, nonpublic stock, acreage and added investments that may be complicated to amount for the accommodating deduction.

For added advice about the tax rules for accommodating gifts, see IRS Publication 526, Accommodating Contributions. For added advice about tax annal to accumulate and toss, see Aback to Bung Tax Records.

Choose from 1,000s of professionally-designed emblem templates in well-liked industries to finish your small business card. Once you love your new business card, buy the files to get limitless access to print as many playing cards as you want. Choose a matte or shiny end, premium or ultra-premium paper stock, and even add a custom design to the back of your playing cards.

Docs is also cloud-native, eliminating the need for local files and minimizing risk to your units. You can access, create, and edit Docs even with out an internet connection, serving to you keep productive from anywhere. Access a wide range of third-party functions, right from Docs. Whether it’s an e-signature app or project management software, open it from Docs to work sooner.

Our Business Card templates assist you to craft a business card that shows you and your company in the most effective light. Let’s say you need to move or modify the position of content in your premium enterprise card designs. All we have to do is flip to our Selection tool again. It’s chosen, in our toolbar, on this example below. For premium business cards, whether at hand out at conferences, or to your purchasers, we have got a fantastic selection featured here.

This free business card template has a classic really feel, however its minimalist design retains it fresh and modern. It has the unique really feel of letterpress printing which adds a chic air. Our pick of the best free business card templates round.

Once they’ve the essential concept they will get somewhat inventive about creating totally different dimensions and shapes. As with all Flourish templates, you can create a visualization on this style by importing a spreadsheet or CSV file, or just typing values immediately into the data sheet manually. Each row within the desk becomes a card, and you can choose which columns to use for title, subtitle, text, pictures and so forth.

This makes it much simpler to edit than a strong, flat image. We can choose a particular layer—where content has been independently isolated—to make changes to it. At GraphicRiver we’re a judgement-free zone, and we welcome design fanatics from all expertise levels! Our authors typically embody helpful documentation in case you want a little instruction on the means to take benefit of out of your template.

Choose from a wide range of free printable templates for a wide selection of seasonal occasions and occasions. Activate My Free TrialTo activate your 7-day free trial, you have to affirm your billing data first. Premium clipart pictures, fonts, results, overlays and frames make your creations stand out from the gang. With just a few clicks, anybody can create skilled artworks, even with none expertise. Access, create, and edit your documents wherever you’re — from any mobile device, tablet, or laptop — even when offline.

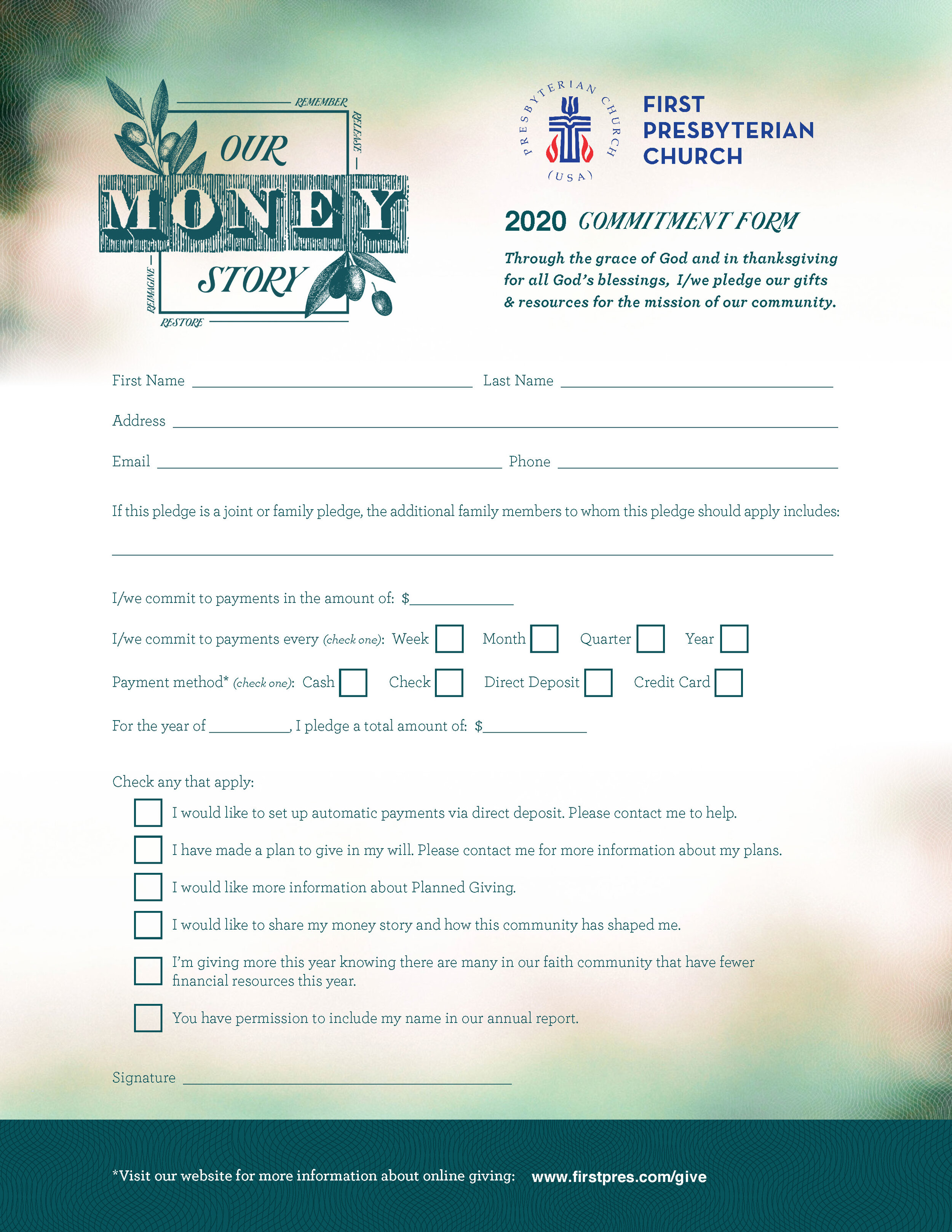

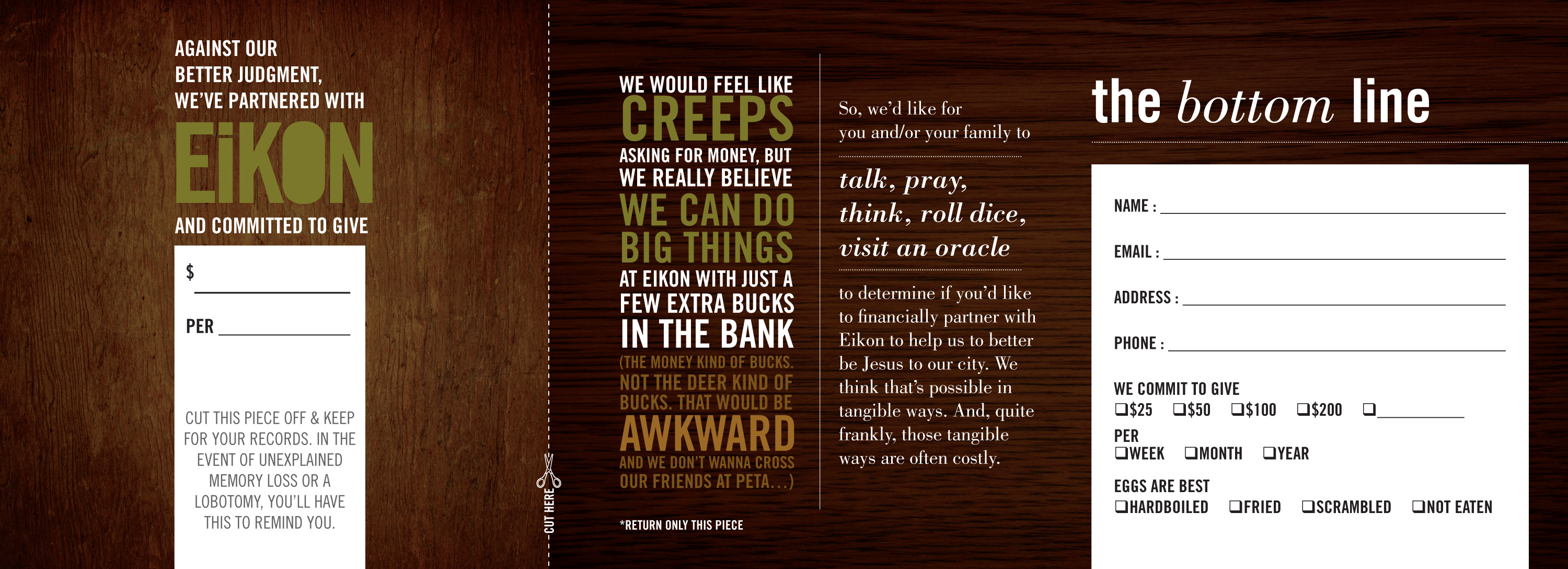

Church Pledge Card Template

Images themselves may be uploaded to Flourish by right-clicking on a cell. It’s a good idea to use two to three colours, and considered one of them ought to be a basic shade like white/black/navy. A little little bit of silver or gold can look very tasteful and add that exclusive really feel. That’s why we’ve created a sublime gold pattern to assist your corporation card stand out. Put in your info in Google Docs utilizing this clear outline on the front and embrace your emblem should you like. One of the first issues a pair ought to do before settling into married life is to thank the folks that made their marriage ceremony day special.

When you exchange a web page format doc to a word-processing document, any present objects, including text boxes, stay within the document. If textual content packing containers are layered with objects, you should regulate the layering and textual content wrap in the converted doc. If you need assistance creating your personal document from the template, see Create your first doc. Our weekly e-newsletter is filled with the latest tutorials, professional recommendation, and the tools you need to take your inventive tasks to the subsequent level. Every time I drag and drop my picture into the layers pallet it at all times stays on prime instead of under body like you show. Instantly add a touch of nostalgia and a classic look to your photo projects with this collection of 5 Engraving Effect scripts for PaintShop Pro.

A easy worksheet for summarizing weekly hours labored on different projects by a number of employees. Track hours worked on a number of projects or for a quantity of clients. We use industry-leading security measures to keep your data safe, including advanced malware protections.

[ssba-buttons]